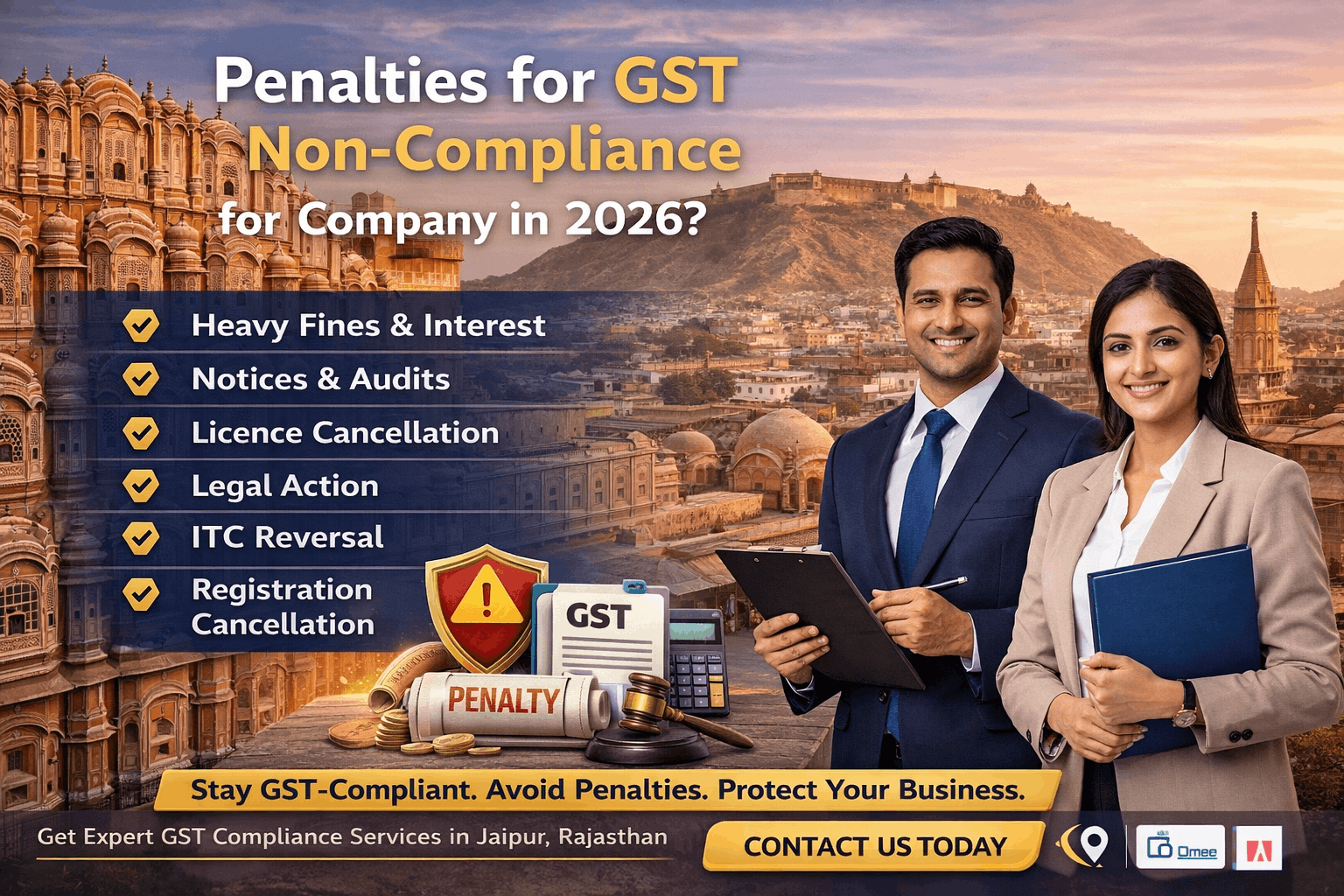

What Are the Penalties for GST Non-Compliance for a Company in 2026?

Goods and Services Tax (GST) has transformed India’s indirect tax system, but GST compliance remains a major challenge for startups, MSMEs, corporates, and foreign companies operating in India. As we move into 2026, enforcement has become stricter, technology-driven, and penalty-focused.

Understanding the penalties for GST non-compliance is no longer optional—it is a business necessity. Even minor lapses can attract heavy fines, interest, cancellation of registration, and legal proceedings.

This detailed guide explains GST non-compliance penalties in 2026, with practical examples, risks, and how professional consulting services in Jaipur, Rajasthan can help your business stay compliant.

Why GST Compliance Is Critically Important in 2026

GST law is designed around self-assessment, transparency, and digital tracking. With AI-based scrutiny, data matching, and real-time reporting, authorities can easily detect mismatches and defaults.

Business Importance of GST Compliance

-

Avoid financial penalties and interest

-

Maintain uninterrupted business operations

-

Protect company reputation and creditworthiness

-

Enable smooth audits, funding, and expansions

-

Ensure eligibility for input tax credit (ITC)

For businesses availing services in Jaipur, Rajasthan, local GST enforcement has become faster and more proactive.

What Is GST Non-Compliance?

GST non-compliance occurs when a registered or liable business fails to meet statutory GST obligations.

Common GST Non-Compliance Areas

-

Failure to register under GST

-

Late or non-filing of GST returns

-

Short payment or non-payment of GST

-

Wrong availment of Input Tax Credit

-

Issuing incorrect or fake invoices

-

Non-maintenance of records

Each default attracts specific penalties under the CGST Act, SGST Act, and IGST Act.

Key Penalties for GST Non-Compliance in 20261. Penalty for Non-Registration Under GST

If a business required to register fails to do so:

-

Penalty: 10% of tax due

-

Minimum penalty: ₹10,000

-

Fraud cases: 100% of tax due

📌 Example:

A startup in Jaipur crosses the GST threshold but does not register. On detection, GST authorities can impose a penalty equal to the entire tax liability.

2. Late Filing of GST Returns – GSTR-1, GSTR-3B, etc.

Late filing remains the most common compliance lapse.

Late Fee (As of 2026):

-

₹50 per day (₹25 CGST + ₹25 SGST)

-

₹20 per day for NIL returns

-

Maximum cap: ₹5,000 per return

Interest:

-

18% per annum on tax payable

Even MSMEs face strict recovery measures if delays persist.

3. Penalty for Non-Payment or Short Payment of GST

📌 Example:

An MSME claims excess ITC due to incorrect invoices. If classified as misstatement, penalties apply along with interest.

4. Wrong Availment of Input Tax Credit (ITC)

Wrong ITC claims are closely monitored in 2026.

-

Interest: 18% per annum

-

Penalty: Up to 100% of wrongly availed ITC (in fraud cases)

-

Reversal of ITC mandatory

This is especially risky for startups and companies scaling operations quickly.

5. Penalty for Issuing Incorrect Invoices

Incorrect invoices include:

-

Missing GSTIN

-

Wrong tax rate

-

Fake or backdated invoices

Penalty: ₹25,000 per incorrect invoice

This applies equally to startups, MSMEs, and corporates.

6. Penalty for Non-Maintenance of Records

Businesses must maintain GST records for at least 6 years.

-

Penalty: ₹10,000 or tax due (whichever is higher)

This is a frequent issue during audits.

Penalties GST for MSME – Special Considerations

While MSMEs enjoy certain procedural relaxations, penalties still apply fully.

Common MSME GST Risks

-

Delayed return filing due to cash flow issues

-

Improper ITC reconciliation

-

Lack of professional compliance support

Professional consulting helps MSMEs reduce risk exposure while optimizing compliance costs.

GST Non-Compliance Penalties for Startup and Company

Startups often face penalties due to:

-

Rapid scaling without compliance systems

-

Misunderstanding GST applicability

-

International transactions without proper GST treatment

📌 Important:

GST penalties can block funding rounds, due diligence approvals, and investor confidence.

Certification and Licences – Hidden GST Compliance Risks

GST compliance is closely linked with other registrations:

-

GST Registration

-

MSME / Udyam Registration

-

Shops & Establishment Act

-

Import Export Code (IEC)

Mismatch across certifications and licences often triggers GST scrutiny.

Step-by-Step: How to Avoid GST Penalties in 2026Step 1: Correct GST Registration

Ensure timely and accurate GST registration in Jaipur or applicable state.

Step 2: Timely Return Filing

Automate reminders and maintain a compliance calendar.

Step 3: Monthly ITC Reconciliation

Match GSTR-2B with purchase records.

Step 4: Maintain Proper Documentation

Invoices, books, and records must be audit-ready.

Step 5: Regular Professional Review

Quarterly GST health checks prevent long-term penalties.

Common GST Compliance Mistakes Businesses Make

-

Ignoring NIL return filing

-

Claiming ITC without valid invoices

-

Late response to GST notices

-

Treating GST as a one-time activity

-

Not updating registrations on business changes

Each mistake increases financial and legal risk.

Why Professional GST Consulting Services MatterBenefits of Expert Support

-

End-to-end GST compliance

-

Penalty risk mitigation

-

Notice handling and representation

-

Audit and assessment support

-

Strategic GST planning

For businesses availing GST services in Jaipur, Rajasthan, local consultants offer faster coordination with authorities.

Internal Linking Suggestions (For SEO)

-

GST Registration Services

-

GST Return Filing & Compliance

-

MSME Registration Services

-

Startup Legal & Tax Advisory

-

Business Compliance Blogs

FAQs – Penalties for GST Non-Compliance (2026)1. What is the maximum penalty for GST non-compliance?

In fraud cases, penalties can go up to 100% of the tax amount, along with interest and prosecution.

2. Is late GST return filing still penalized in 2026?

Yes, late fees and interest continue to apply strictly.

3. Are MSMEs exempt from GST penalties?

No, MSMEs are not exempt, though procedural relief may apply in limited cases.

4. Can GST registration be cancelled due to non-compliance?

Yes, repeated defaults can lead to cancellation of GST registration.

5. How can startups avoid GST penalties?

By timely registration, accurate ITC claims, and professional compliance support.

6. Do Jaipur-based businesses face local GST audits?

Yes, state GST authorities actively conduct audits in Rajasthan.

Conclusion: GST Compliance in Jaipur, Rajasthan

With increasing enforcement in 2026, GST non-compliance can severely impact business continuity. Companies operating in or expanding to Jaipur, Rajasthan must prioritize accurate GST compliance to avoid penalties, interest, and legal exposure.

Professional GST advisory ensures peace of mind, financial safety, and long-term growth.

Call to Action

Worried about GST penalties or compliance risks?

Let experienced professionals handle your GST obligations.

👉 Contact our expert GST consultants today for reliable GST registration, compliance, and penalty management services in Jaipur, Rajasthan—and focus on growing your business with confidence.